An emergency fund, as the name suggests, is money saved to cover unexpected expenses, such as medical emergencies, car repairs, or even a sudden job loss. However, understanding its importance goes beyond just recognizing its primary function. In this article, we’ll delve into the 7 benefits of building an emergency fund. By the way, did you know that just as there are benefits of having an emergency stash, there are 7 benefits of breakfast too? Yep, both nourish you, albeit in different ways.

Financial Security

Having an emergency fund provides a cushion against unforeseen financial shocks. This is crucial because such shocks can happen at any time. Whether it’s a medical emergency or sudden car repairs, your emergency fund acts as a safety net. This means that when the unexpected happens, instead of reaching for your credit card or taking out a loan, you can rely on your savings.

Reduced Stress

Imagine the peace of mind knowing that you have money tucked away specifically for emergencies. The financial security that comes from building an emergency fund translates to reduced stress in everyday life. This can be immensely beneficial for your mental health, ensuring you’re not constantly worried about potential financial pitfalls.

Avoidance of Debt

It’s easy to fall into debt when unexpected expenses arise and there’s no money saved to cover them. With an emergency fund, you eliminate the need to rely on high-interest credit cards or loans to manage unplanned costs. As a result, you avoid accruing unnecessary debts and save money in the long run.

Financial Independence

Having a robust emergency fund is a step towards achieving financial independence. It gives you the liberty to make choices that aren’t purely based on immediate financial need. This could mean turning down a job you don’t want or investing in opportunities that require upfront capital.

Greater Flexibility with Investments

When you have a safety net, it offers you the flexibility to take calculated risks in your investment ventures. Knowing that your essentials are covered gives you the confidence to diversify your investment portfolio and possibly reap higher rewards.

Improved Credit Scores

By avoiding unnecessary debt and making timely payments (since you won’t be strapped for cash), you inadvertently improve your credit score. A good credit score can be beneficial when seeking a loan, negotiating interest rates, or even applying for some jobs.

Allows for Life’s Unexpected Opportunities

While the main idea behind an emergency fund is to cover unplanned expenses, it’s worth noting that not all unexpected events are negative. Perhaps there’s a last-minute travel opportunity, a course you want to take on a whim, or a unique investment opportunity. With an emergency fund, you have the means to seize these opportunities without derailing your financial plans.

Starting Your Emergency Fund: Practical Steps

If you’re now convinced of the 7 benefits of building an emergency fund, it’s essential to understand how to go about creating one. Here are some practical steps to help you on this journey:

Set a Goal

Determine how much money you want to have in your emergency fund. A common recommendation is to save three to six months’ worth of living expenses. However, the right amount can vary depending on individual circumstances. If your job is relatively stable, three months might suffice. If you’re a freelancer or in a volatile industry, aiming for a longer buffer could be prudent.

Open a Separate Savings Account

Keeping your emergency fund in a separate account can reduce the temptation to dip into it for non-emergencies. Consider opening a high-yield savings account that provides a better interest rate than standard savings accounts.

Automate Your Savings

Set up an automatic transfer to your emergency fund every time you receive a paycheck. Even if it’s a small amount, it can add up over time. And because it’s automatic, you won’t even miss the money.

Cut Unnecessary Expenses

Evaluate your monthly expenses and identify areas where you can cut back. Maybe it’s that daily coffee shop visit, or perhaps it’s a subscription you no longer use. Redirect these savings into your emergency fund.

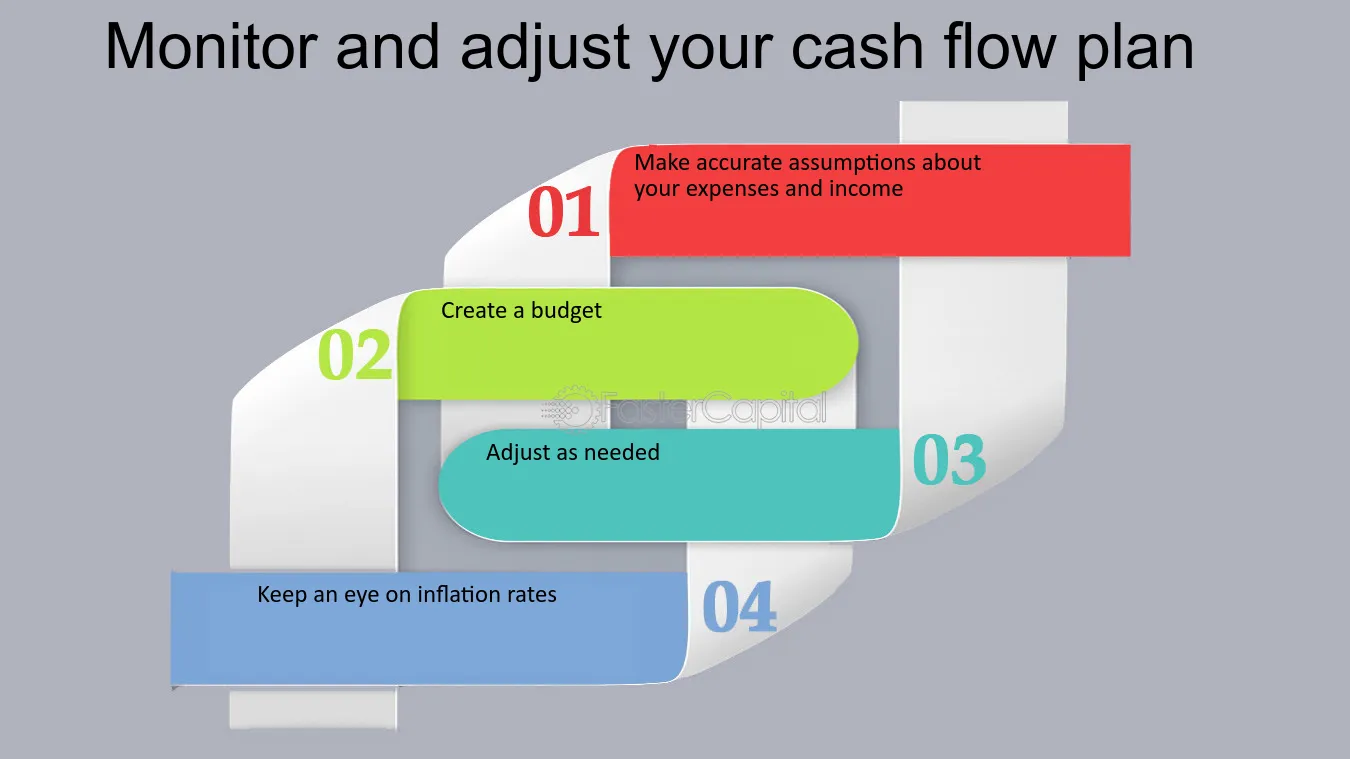

Monitor and Adjust

Review your progress periodically. If you reach your initial goal and feel comfortable, you might decide to increase it. Alternatively, if you face financial hardships, consider adjusting your contributions, but don’t stop them entirely.

Avoid Complacency

Once you’ve reached your goal, it might be tempting to use the money for something else. However, always remember the purpose of this fund. It’s there to give you peace of mind and financial stability during unexpected events.

Celebrate Milestones

Building an emergency fund is a significant accomplishment, and it’s essential to recognize your progress. Celebrate when you reach 25%, 50%, 75%, and finally 100% of your goal. It’ll motivate you to keep going!

The Ripple Effect of a Strong Financial Foundation

Once you have an established emergency fund, you’ll notice its impact ripple throughout various aspects of your life. This is akin to the sustained energy and focus you feel after a wholesome breakfast. Here’s a deeper look into this ripple effect:

Improved Financial Habits

The discipline required to build an emergency fund often triggers improved overall financial habits. You become more conscious of your spending, make smarter investment decisions, and prioritize saving for other life goals, like buying a home or retirement.

Enhanced Relationship Dynamics

Financial challenges can strain relationships. With a safety net, money-related arguments can decrease, leading to more harmonious interactions with loved ones.

Boosted Career Choices

With an emergency fund in place, you’re not tied down to a job just because of the paycheck. It can offer the freedom to explore careers you’re passionate about, even if they come with initial pay cuts or uncertainties.

Expansion of Life Experiences

With a buffer for unexpected expenses, you might also find room to budget for experiences like travel, workshops, or hobbies. These experiences enrich your life and offer personal growth opportunities.

Increased Generosity

Financial stability might also empower you to be more charitable. Whether it’s supporting a friend in need or donating to a cause close to your heart, having a cushion allows you to give back with ease.

Prevention of Unnecessary Losses

An emergency fund ensures you can immediately cover unexpected costs, avoiding penalties, interest, or other losses associated with delayed payments.

Building a Legacy

Over time, sound financial habits, starting with an emergency fund, can help you build a legacy. It sets the stage for wealth accumulation and ensures a more secure financial future for your family.

Final Thoughts

Building an emergency fund is one of the most responsible and empowering financial decisions you can make. It’s an investment in your peace of mind, financial health, and future. And while the journey might seem challenging, the benefits far outweigh the effort. If you haven’t started on this journey, now is the time. Even small contributions can accumulate over time, and before you know it, you’ll have a robust fund that offers security, peace of mind, and freedom.

So, with a spoon in one hand (preferably filled with your favorite breakfast) and a savings plan in the other, embark on this journey to financial stability. And remember, every bit you save brings you closer to a more secure and peaceful future.