Managing finances can be challenging, especially when it comes to credit cards. Their convenience, potential rewards, and ease of use make them an essential tool for many. However, a misstep can lead to financial chaos. Whether you’re a new cardholder or you’ve been swiping for years, it’s essential to avoid these common pitfalls. Specifically, let’s dive deep to avoid these 5 common credit card mistakes.

Carrying a High Balance

One of the top mistakes made by many is maintaining a high balance on their credit cards. It’s not just about the looming debt; carrying a high balance can significantly impact your credit score. This is due to a term called credit utilization rate.

Credit Utilization Rate: This is the ratio of your credit card balances to their credit limits. If you’re consistently using a high percentage of your available credit, lenders might view you as a high-risk borrower.

Solution: Aim to keep your balance low, preferably under 30% of your available credit limit. Not only does this look good on your credit report, but it also ensures you’re not amassing debt beyond your means.

Missing or Late Payments

Falling behind on payments can be damaging in more than one way. Not only will you incur late fees, but your credit score can also take a significant hit. Payment history contributes to 35% of your FICO score, making it a critical aspect of your financial health.

Solution: Automate your payments! Most credit card providers allow you to set up automatic monthly payments. This ensures that even if you forget, your minimum payment gets covered. Alternatively, set reminders to ensure you pay your bills on time.

Only Making Minimum Payments

While making the minimum payment keeps you from incurring late fees and saves your credit report from negative marks, it’s not a long-term strategy. Paying only the minimum can lead to higher interest charges over time.

Solution: Whenever possible, aim to pay more than the minimum amount. Even an extra $20 or $50 can make a significant difference in the interest you’ll pay over the life of the balance. Create a budget, prioritize debt repayment, and consider using any extra funds, like tax returns or bonuses, to pay down your credit card balance.

Applying for Multiple Cards at Once

Often, people wonder, “I have 5 credit cards, is that too many?” The number of cards you have isn’t necessarily a problem, but applying for many in a short time frame can be. Each time you apply for a card, the lender makes a hard inquiry on your credit report, which can temporarily lower your score.

Solution: Only apply for new credit cards when necessary. If you’re looking for a card with better rewards or lower interest rates, research thoroughly before applying. Remember, it’s not about how many cards you have but how you manage them.

Ignoring Monthly Statements

With digital banking on the rise, many of us set up payments and forget about them. However not reviewing your monthly statements can mean missing out on unauthorized charges, interest rate hikes, or changes in your credit card’s terms and conditions.

Solution: Set a specific time each month to review your statement. Look for any unfamiliar transactions and ensure you’re not being charged for a service you didn’t sign up for. Plus, being aware of your spending habits can aid in better budgeting and financial management.

Bonus Tips

While we’ve covered the most common mistakes, it’s also essential to note other considerations that can help enhance your credit card experience.

Not Maximizing Rewards and Benefits

Many credit cards come with perks like cashback, airline miles, or discounts on specific brands. Failing to take advantage of these can mean leaving money on the table.

Solution: Understand the reward structure of your credit cards. If you have a card that offers more cashback on groceries, use it for supermarket visits. Or, if you have a travel card, make sure you use it for booking flights and hotels to maximize miles or points. Regularly check for any special promotions or offers associated with your card.

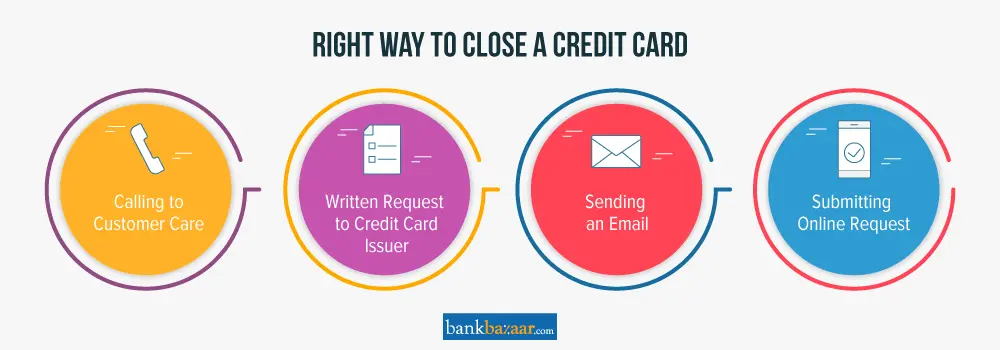

Closing Old Credit Cards Without a Strategy

It might seem like a good idea to close a credit card, especially if you’re not using it. However, doing so can negatively impact your credit utilization rate and the length of your credit history, both of which play a role in your credit score.

Solution: If an old card doesn’t have an annual fee, consider keeping it open. Use it for small purchases every once in a while to keep it active. If you must close a card, especially one with an annual fee, ensure it doesn’t drastically increase your credit utilization or significantly decrease the average age of your accounts.

Falling for ‘Special’ Offers Without Reading the Fine Print

Credit card companies often entice customers with special offers, such as 0% interest rates for a specific period. However, failing to meet the terms of these offers, like not paying off the balance before the promotional period ends, can lead to substantial interest charges.

Solution: Before accepting any special offers, read the terms and conditions thoroughly. Understand when the promotional period ends and what the interest rate will be afterward. Set reminders to ensure you take the necessary action before the offer expires.

Not Setting a Budget

It’s easy to get carried away with spending when you’re not keeping track of your expenses. Without a budget, you might find yourself making unnecessary purchases and accruing debt.

Solution: Set a monthly budget and stick to it. Allocate funds for essentials like bills, groceries, and savings first. Use apps or traditional methods to track your spending and ensure you don’t exceed your budget.

Not Reporting Lost or Stolen Cards Immediately

Time is of the essence if your card is misplaced or stolen. The longer you wait, the higher the chance of unauthorized transactions.

Solution: If you suspect your card is lost or has been stolen, report it to your credit card company immediately. Most companies offer 24/7 customer service for such emergencies. Acting fast limits your liability for any unauthorized charges.

Beyond Credit Cards: Building Financial Literacy

While we’ve deeply explored the realm of credit cards, understanding broader financial literacy concepts can further shield you from potential monetary pitfalls. Let’s delve into a few overarching principles.

Failing to Regularly Check Your Credit Report

Your credit report is a reflection of your financial behaviors. An unnoticed error or unrecognized account could indicate identity theft or inaccuracies that could impact your credit score.

Solution: Make it a habit to check your credit report from the three major bureaus annually. If you notice any discrepancies, take steps to address them immediately. Many services offer free annual credit reports, ensuring you’re always in the know.

Not Building an Emergency Fund

Relying solely on credit cards during emergencies can lead to significant debt. An unexpected medical emergency, job loss, or significant repair can disrupt even the most well-planned budgets.

Solution: Aim to save three to six months’ worth of living expenses in an easily accessible savings account. This cushion can be a lifesaver during unexpected financial hiccups, ensuring you don’t need to rely solely on credit.

Not Continuously Educating Yourself on Financial Matters

The financial world is ever-evolving, with new tools, products, and best practices emerging regularly.

Solution: Dedicate time to read financial news, blogs, and books. Consider attending financial literacy workshops or webinars. The more you know, the better equipped you’ll be to make informed decisions.

Overlooking the Importance of Diversified Investments

While this goes beyond the realm of credit cards, relying solely on one financial instrument or investment can be risky.

Solution: Diversify your investments. This doesn’t mean you need a vast portfolio, but spreading your money across different types of investments can reduce risk. Consider consulting with a financial advisor to build a strategy tailored to your goals and risk tolerance.

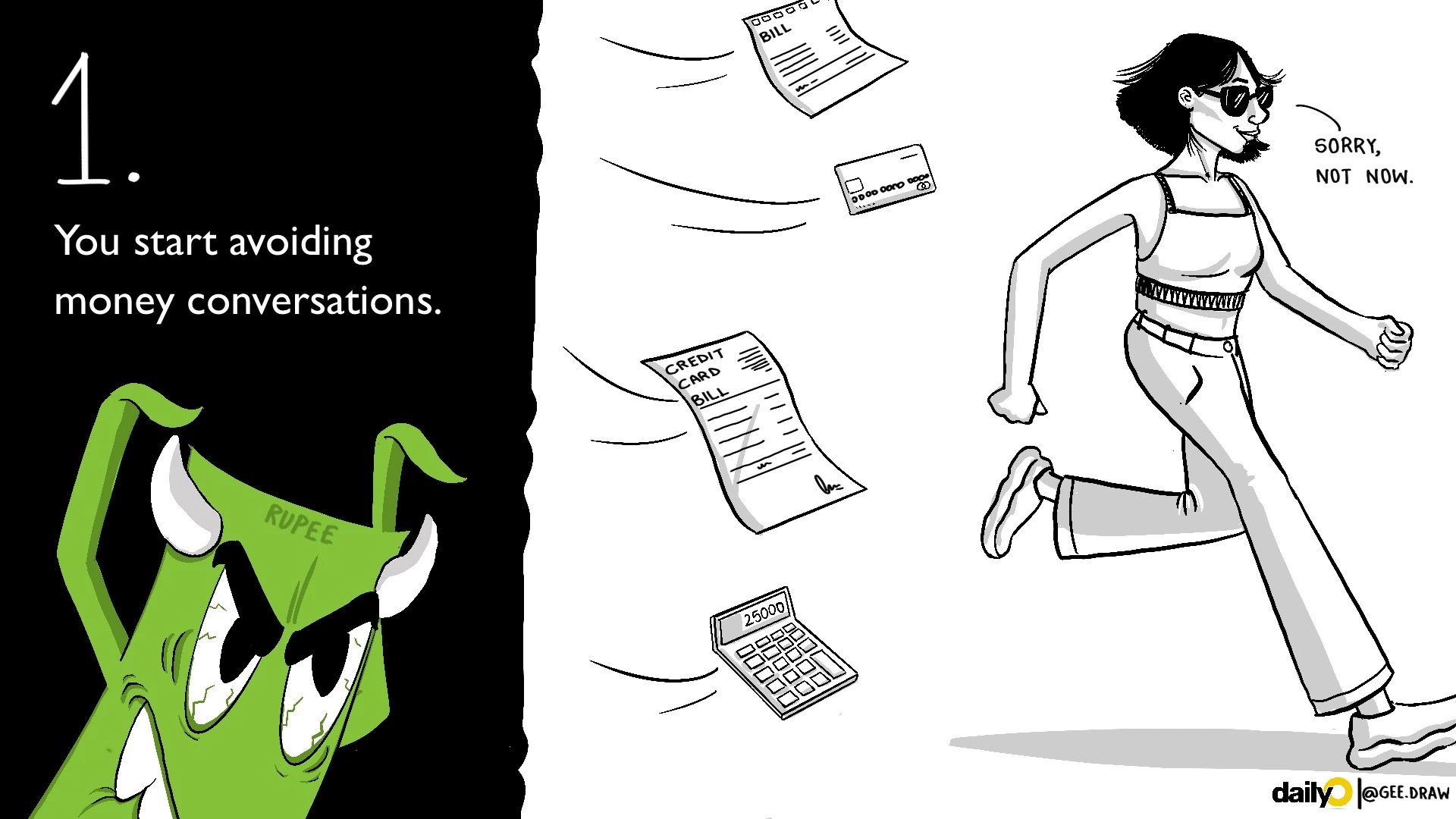

Avoiding Conversations about Money

Talking about money can be taboo for many, but avoiding these discussions, especially with significant others or family members, can lead to misunderstandings and financial missteps.

Solution: Engage in open dialogues about financial expectations, goals, and challenges. Whether it’s setting a family budget, planning for a big purchase, or discussing retirement plans, clear communication is key.

In Conclusion

Credit cards can be a great financial tool when used wisely. However, mismanagement can lead to a spiral of debt and credit score damage. By being aware of and avoiding these 5 common credit card mistakes, you position yourself for financial success. Whether you’re a novice cardholder or someone wondering if “I have 5 credit cards, is that too many?“, the key lies in responsible management. Stay informed, make timely payments, and use your cards as a tool rather than a crutch.