In a world where financial literacy is key to personal success, understanding and cultivating good financial habits is essential. This article delves into 10 good financial habits that will change your life, offering not just advice but a transformative approach to managing your finances. These habits are more than mere tips; they are stepping stones to a secure and prosperous future.

Set Clear Financial Goals

Begin by setting clear, achievable financial goals. Whether it’s saving for retirement, buying a house, or just building an emergency fund, having specific targets in mind gives you something tangible to work toward. This habit is not just about dreaming big, but also about creating a realistic roadmap to reach those dreams.

Create a Budget and Stick to It

Budgeting is often perceived as restrictive, but it’s actually about understanding and controlling where your money goes. By creating a budget, you’re taking a significant step toward financial discipline. Utilize tools like budgeting apps to help you track and manage your spending effectively.

Save Regularly

One of the cornerstone 10 good money habits is saving regularly. Whether it’s a small percentage of your income or a fixed monthly amount, make saving a non-negotiable part of your financial routine. Over time, these savings accumulate, paving the way for financial security.

Invest Wisely

Investing isn’t just for the wealthy; it’s a crucial habit for anyone looking to grow their wealth. Start with low-risk investments and gradually diversify your portfolio. Educate yourself about different investment options or consult with a financial advisor.

Limit Debt

Debt can be a slippery slope leading to financial distress. Make it a habit to limit your debt intake, especially high-interest debt like credit cards. Focus on paying off existing debts and avoid taking on new debts unless necessary.

Plan for Emergencies

Life is unpredictable, and financial emergencies can arise at any time. Establishing an emergency fund is a critical habit. Aim to save enough to cover at least three to six months of living expenses.

Regular Financial Check-ups

Just like your health, your finances need regular check-ups. This involves reviewing your budget, tracking your investments, and adjusting your savings goals. Annual financial reviews can be particularly effective.

Educate Yourself Financially

Knowledge is power, especially when it comes to finances. Stay informed about financial trends, read books, attend seminars, or even take courses to enhance your financial literacy. Websites like Khan Academy offer free resources on various financial topics.

Cultivate Multiple Income Streams

Don’t rely solely on your primary job for income. Look for ways to generate passive income or start a side hustle. This habit not only boosts your income but also provides a safety net in case of job loss.

Practice Mindful Spending

Mindful spending involves being aware of your spending habits and questioning each purchase. It’s about distinguishing between ‘wants’ and ‘needs’ and making spending choices that align with your financial goals.

Maximize Your Financial Potential

By adopting these habits, you are not just managing your finances; you are maximizing your financial potential. Each habit acts as a building block towards a more secure and prosperous financial future. Let’s delve deeper into how these habits can be effectively implemented and maintained over time.

Implementing Good Financial Habits

Start Small: Begin with manageable goals and gradually build your financial discipline. For instance, start by saving a small percentage of your income and increase it as you become more comfortable.

Use Technology: Leverage financial apps and tools to automate savings, track expenses, and manage investments. This not only simplifies the process but also keeps you consistently engaged with your finances.

Seek Professional Advice: Don’t hesitate to consult financial advisors or professionals, especially when making significant financial decisions like investments or taking loans.

Be Consistent: Consistency is key. Make these habits a regular part of your routine. It’s the small, consistent steps that lead to significant results.

Stay Motivated: Keep reminding yourself of your financial goals and why they are important to you. This will help you stay motivated and on track.

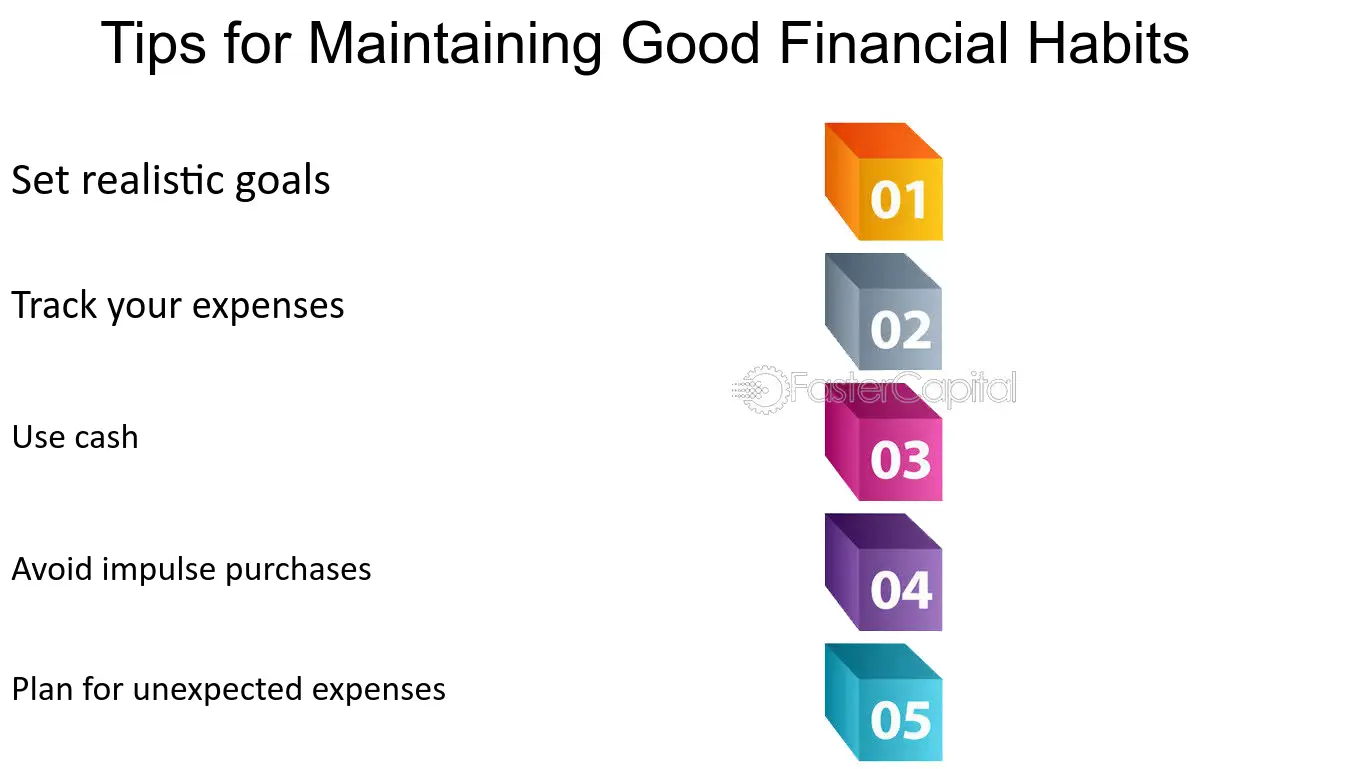

Maintaining Good Financial Habits

Review and Adjust Regularly: As your life circumstances change, so should your financial strategies. Regularly review and adjust your goals, budget, and investment plans.

Build a Support System: Surround yourself with people who share similar financial aspirations. This could be a partner, family member, or a financial accountability group.

Celebrate Milestones: Celebrate when you reach financial milestones, whether it’s paying off a debt or reaching a savings goal. This helps in reinforcing positive financial behaviors.

Stay Informed: The financial world is always evolving. Stay updated with the latest trends and changes in laws that might affect your finances.

Learn from Mistakes: Financial mistakes are inevitable. Instead of dwelling on them, learn from them and use these lessons to make better decisions in the future.

The Impact of Good Financial Habits

- Increased Financial Security: These habits lay the foundation for a secure financial future, reducing the stress associated with financial uncertainties.

- Wealth Accumulation: Over time, these habits lead to wealth accumulation, providing you with more options and opportunities in life.

- Better Financial Decision Making: With increased knowledge and discipline, you’ll make more informed and effective financial decisions.

- Improved Quality of Life: Ultimately, good financial habits lead to an improved quality of life. They enable you to live within your means, reduce financial stress, and provide a sense of accomplishment.

Embracing a Financially Empowered Future

The journey towards a financially empowered future is ongoing and dynamic. As you continue to implement and maintain these good financial habits, you’ll discover more about your financial strengths and areas for improvement. Here’s how you can further solidify these habits into your lifestyle:

Advanced Strategies for Financial Growth

Invest in Your Education: Continuously educate yourself about financial markets, investment strategies, and economic trends. Consider taking courses or certifications to deepen your financial knowledge.

Explore Advanced Investment Opportunities: Once you’re comfortable with basic investments, explore more advanced options like stocks, real estate, or even starting your own business.

Optimize Tax Strategies: Understanding tax implications can significantly affect your finances. Seek advice from tax professionals to optimize your tax strategies and maximize savings.

Build a Strong Credit Score: A good credit score can open doors to better interest rates and financial opportunities. Work towards building and maintaining a strong credit score.

Engage in Philanthropy: If your financial situation allows, consider giving back through philanthropy. Not only does this contribute to societal good, but it also can be fulfilling on a personal level.

Long-Term Financial Sustainability

- Plan for Retirement: It’s never too early to start planning for retirement. Explore various retirement plans and contribute regularly to build a comfortable nest egg.

- Create a Legacy Plan: Think about how you want to manage your assets in the long term. This might involve setting up trusts, writing a will, or planning for estate taxes.

- Focus on Health and Wellness: Remember that your health has a direct impact on your financial well-being. Invest in your health to avoid future financial burdens caused by medical expenses.

- Sustainable and Ethical Investing: Consider incorporating sustainable and ethical investments into your portfolio. This approach aligns your financial growth with your values and the well-being of society.

The Broader Impact of Good Financial Habits

- Economic Stability: By managing your finances effectively, you contribute to broader economic stability and growth.

- Positive Influence: Your financial habits can positively influence those around you, including family and friends, by setting a good example.

- Social Responsibility: Good financial habits often lead to increased awareness and responsibility towards social and environmental issues.

Conclusion

In conclusion, the 10 good financial habits that will change your life are more than just tips; they represent a holistic approach to financial well-being. By embracing these habits, you’re not only securing your financial future but also contributing to a more stable and prosperous society.

Remember, the journey of financial empowerment is continuous. Stay committed, adaptable, and proactive in your financial endeavors. For more insights into financial planning and wealth management, don’t forget to check out Your Financial Guide.